Digital transformation has been a fundamental enabler for companies offering financial services. It is inappropriate to underrate the opportunities a FinTech firm can derive by implementing technology. The FinTech industry continues to invest in innovations creating exciting products and empowering customers by liberating them to go by their preferences. The speed at which FinTech has expanded, has prompted the government to introduce regulatory compliance, which allows the marketplace to grow cautiously in a controlled way. These regulatory compliances are capable in counter the potential threat that digital payment platforms may come to grips with.

What Is Payment Compliance?

The use of automated payment applications has increased over time, and accredited reasons can vary depending upon the factors affecting the life of people. The increase in the number of payment service operators in India is accompanied by almost equal increase in fraud. The necessity to counter these fraudulent activities has given rise to data security, operational resilience, and third-party management concerns. This is where payment compliance comes into the picture. Payment compliance is a protocol that firms involved in financial services stick to while developing new payment portals. To ensure that every transaction is safe and there is no data leakage, PCI SSC has introduced PCI DSS. Read further to understand PCI DSS Compliance and its benefits in Payment Solutions.

What Is PCI DSS Compliance?

PCI DSS, or Payment Card Industry Data Security Standards is a global forum that brings industry stakeholders together to develop and drive adoption of data security and resources for safe payment worldwide. It is a standard set of security guidelines created by major card brands to ensure that merchants who accept credit card payments maintain a secure environment to protect cardholder’s data.

The PCI DSS standard outlines requirements for security management, policies, procedures, network architecture, software design, and other critical protective measures. All merchants who accept credit cards as payment, must comply with the PCI DSS standard. Importance of regulatory compliance must not be underestimated when it comes to preventing data breaches and reduce the risk of fraud and other security incidents for merchant and the consumer.

Latest Version: PCI DSS v4.0

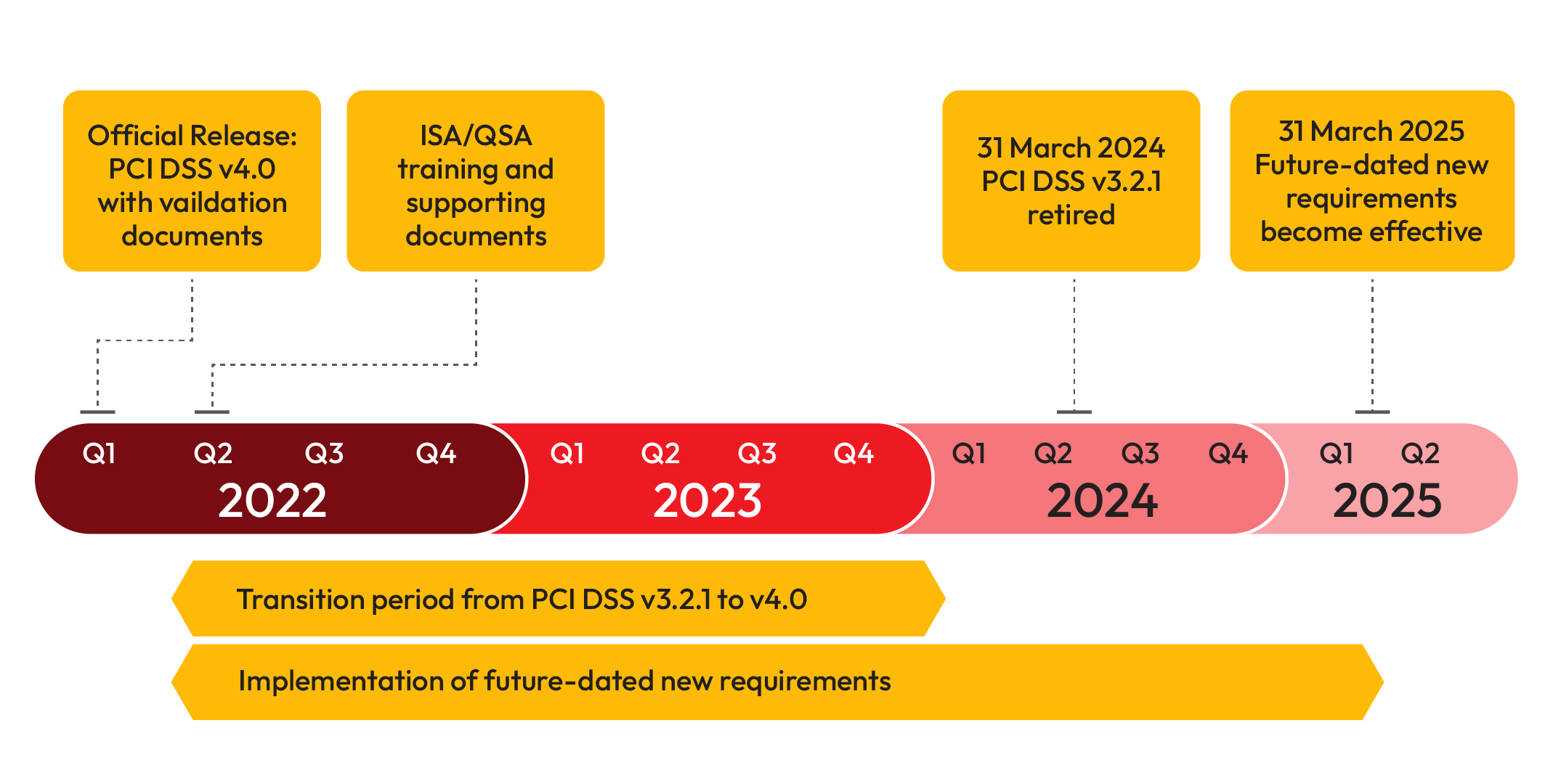

First version of PCI-DSS was created in the year 2004 at the time when, major brands joined forces to design a unified digestible Standard set of policies. A PCI-Security Standards Council was also formed in 2006 to enhance global payment account data security by developing standards and supporting services. Since then, the versions were updated regularly, emphasising the importance of data scoping and log management and data security. PCI DSS version 4.0 is the latest that aims to address developing threats and technologies, facilitating more effective ways to combat new threats to cardholder information and boost payment flexibility.

PCI DSS Objectives and Requirements

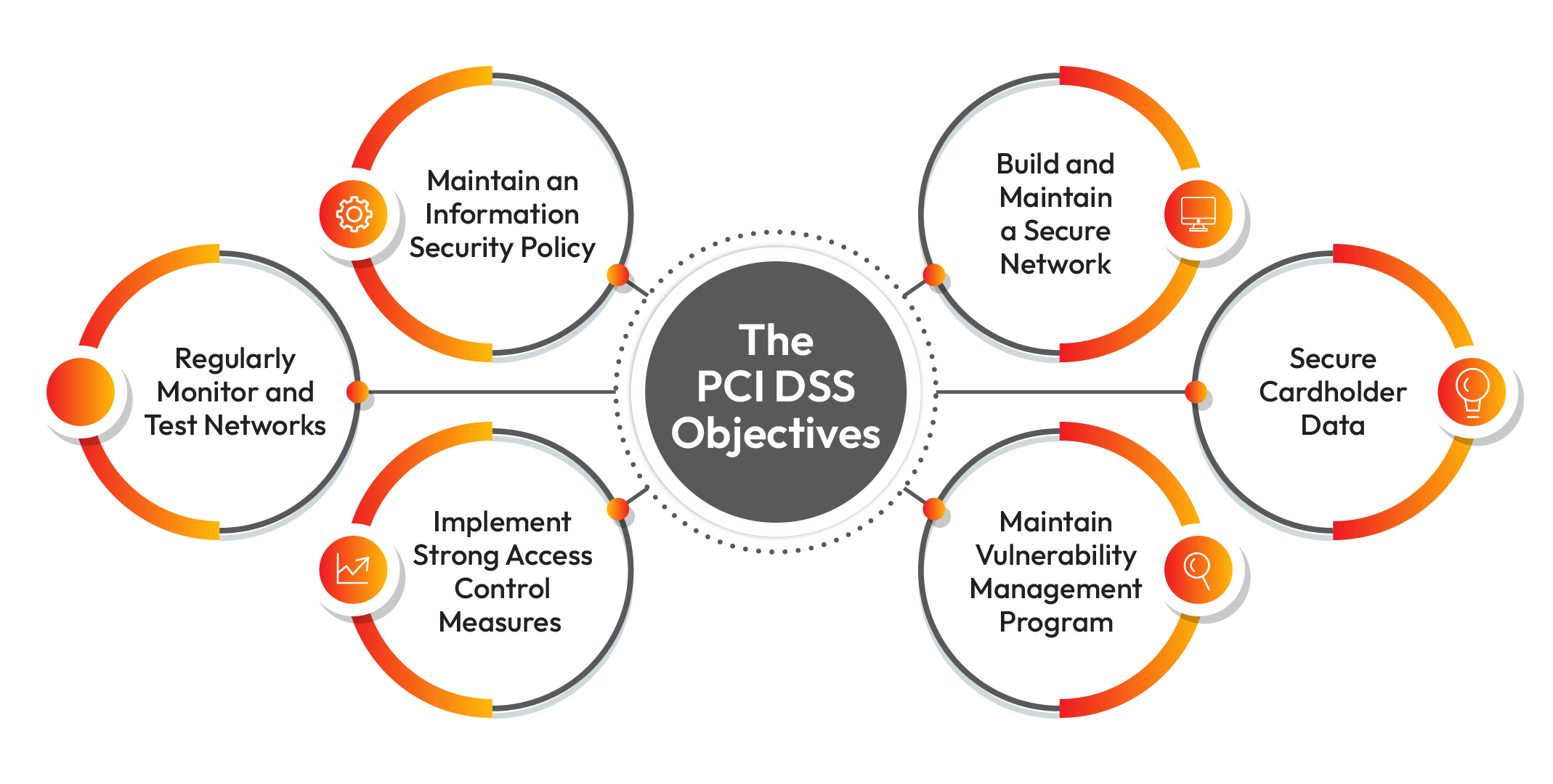

The PCI DSS security standards are organised into six categories that are referred to as “control objectives”.

Under these objectives, PCI DSS has outlined 12 requirements for handling cardholders’ data and maintaining a well-protected network. These requirements are set forth for technical and operational executions, and the focus lies in protecting data throughout. The standards are not limited to just merchants and ISVs but it is applicable to anyone that stores, processes, transmits, or manipulates cardholder data.

The 12 requirements of PCI DSS are:

Requirement 1: Install and maintain a firewall configuration to protect cardholder data.

Requirement 2: Do not use vendor-supplied defaults for system passwords and other security

parameters.

Requirement 3: Protect stored cardholder data.

Requirement 4: Encrypt transmission of cardholder data across open, public networks.

Requirement 5: Use and regularly update anti-virus software or programs.

Requirement 6: Develop and maintain secure systems and applications.

Requirement 7: Restrict access to cardholder data by business need to know.

Requirement 8: Assign a unique ID to each person with computer access.

Requirement 9: Restrict physical access to cardholder data.

Requirement 10: Track and monitor all access to network resources and cardholder data.

Requirement 11: Regularly test security systems and processes.

Requirement 12: Maintain a policy that addresses information security for all personnel.

How does PCI DSS prevent payment fraud?

The core function of PCI DSS is to build a secure network that is impassable for the swindlers, who are over the time are getting equally tech savvy. With the help of special requirements, the Fintech brand needs to adhere before storing card data. Based on the level of compliance required, it is must to secure the network and system that is intolerant to vulnerabilities. Many Merchants reduce their PCI scope by working with a PCI certified payment provider and can securely store customer card data. This spares merchants of all the struggle a firm goes through in securing sensitive user information.

How Pay10 Secures Digital Payment

Pay10 is a leading payment service platform that thrives to empower businesses with technologically backed digital payment solution in India and across boundaries. The platform is PCI DSS Level 1 compliant, certified by top-tier industry standards of compliances. Pay10 payment solutions is a multifaceted platform catering to a wide range of verticals. For more information connect with us.

Frequently Asked Questions

- Q1. What is PCI DSS?

- The Payment Card Industry Data Security Standard (or PCI DSS) represents a set of policies and procedures designed to protect any transaction processed with credit, debit, or cash cards.

- Q2. What is PCI DSS compliant?

- Level 1: For processing 6 million card transactions annually.

- Level 2: For processing 1 to 6 million transactions annually.

- Level 3: For processing 20,000 to 1 million transactions annually.

- Level 4: For processing fewer than 20,000 transactions annually

There are 4 Levels in PCI DSS

- Q3. What are Levels in PCI DSS?

- The brand implements a strong information security policy with a robust fraud management engine for continuous risk management. The payment aggregator has made Digital payment for Indian Customer convenient and hassle free.